Hsbc Wire Transfer Form Pdf

четверг 28 февраля admin 86

For inquiries or complaints, please call HSBC's Customer Services at from Metro Manila, PLDT domestic toll-free, from overseas, (country code) international toll-free for selected countries, or send an email to. If you want to find out more about HSBC's customer feedback procedures, please visit. The Hongkong and Shanghai Banking Corporation Limited is an entity regulated by the Bangko Sentral ng Pilipinas (Bangko Sentral). You may also contact the Bangko Sentral Financial Consumer Protection Department at. Note: Do not provide your account or credit card numbers or disclose any other confidential information or banking instructions through email.

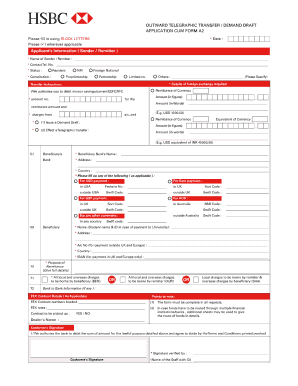

Hsbc.ca Wire Payment Service - Incoming Wire Instructions To efficiently process incoming funds via wire transfer to your HSBC account s the sender of the funds must ensure the following information is included in the payment instructions from the financial institution from which the funds. HSBC Savings Bank Transfer of Funds Application Smart Form Frequently Asked Questions (PDF) HSBC Savings Bank Transfer of Funds Application Smart Form Frequently Asked Questions (PDF) Download link HSBC Savings Bank Application Form for Cashier's Order/Demand Draft (effective January 18, 2016) (PDF) HSBC Savings Bank Application Form for.

Manage your transfers online Important: before making a transfer to a new national or international beneficiary (1), register their bank details online. Transfers You can make national or international transfers online to your pre-registered beneficiary accounts. You can also make national and international transfers from your mobile phone. • Online transfers Transfers in France: Stage 1: follow the links to «Transfers / Make a domestic transfer» in your secure client area. Stage 2: select the account to be debited and the beneficiary account from the drop-down lists displaying the available accounts. Stage 3: check the details entered and confirm the transaction. NB: If the account to be credited is not shown in the list, you will need to register a new beneficiary account.

International transfers: Stage 1: follow the links to «Transfers / Make an international transfer» in your secure client area. Stage 2: select the account to be debited and the beneficiary account from the drop-down lists displaying the available accounts. Stage 3: check the details entered and confirm the transaction. Good know: In the «Transfers» section you can: - view, amend or delete your pending transfers in the «transfers pending» section. - access details of your past transfers made or rejected in the «Transfer history» section. Frank ocean channel orange zip. • Transfers from your mobile phone Stage 1: connect to your HSBC app.

Thus, interactive digital signage installations convey a message way more effectively than any conventional passive digital signage solution ever could. The combination of touchscreen hardware and software offers unlimited possibilities for innovative marketing at point of sale and information.

Stage 2: go to the «Transfers» section. Stage 3: select the account to be debited and the beneficiary account from the drop-down lists displaying the available accounts. Stage 4: check the details entered and confirm the transaction.

NB: transfer fees may be charged: Remember: To request a national transfer from your branch: download, print and fax the form Add a new beneficiary • Free to use External national or international transfers require prior registration of the beneficiary's bank details. You can enter details for new national or international beneficiaries in complete security online. • Easy and safe to use - To add a new beneficiary account (IBAN or free format): follow the links to «Transfers / Manage bank details» in your secure client area. All the information required must be correctly completed in order to avoid the rejection of transfers and possible additional costs. To protect you against fraud, the addition of a new beneficiary must be authenticated by entering a transaction security code generated by your HSBC Secure Key. * Dial +33 810 246 810 from abroad. (1) We would like to remind you that in accordance with current French regulations, individuals, associations and companies which do not have a commercial form, who are French tax residents or are established in France, are required to declare, on their personal or corporate income tax return, the accounts opened, used or closed abroad as well as all accrued income.